Imagine driving down a winding road, the sun setting behind you, and knowing you're fully protected from any unexpected bumps along the way. Choosing the right auto insurance coverage isn't just about meeting legal requirements; it's about safeguarding your financial future against accidents and theft. Understanding your unique driving habits and vehicle value can help you strike the right balance. So, what factors should you consider to guarantee you're adequately covered?

How do you choose the right auto insurance coverage for your needs? It's crucial to evaluate various factors that impact your situation. Start by analyzing your driving habits. If you have a long commute, you're statistically at a higher risk of accidents, which suggests you may need more extensive coverage. Frequent driving increases your exposure, potentially warranting higher limits. If you often drive at night, the reduced visibility can further elevate your risk, making thorough coverage a prudent choice.

Additionally, consider whether you drive mainly in urban or rural settings, as these environments present different levels of risk and insurance needs.

Driving environment matters; urban and rural settings entail distinct risks and insurance requirements.

Next, think about your vehicle's value. If you own a newer car, thorough and collision coverage is critical to protect your investment. In contrast, older vehicles might only require liability coverage if the costs of more extensive protections are prohibitive. If you're driving a high-value or luxury vehicle, specialized insurance could be necessary to adequately cover its worth. Comprehensive coverage can also be beneficial for protecting against non-collision incidents like theft or natural disasters, especially for newer vehicles.

Furthermore, any modifications or upgrades can influence your insurance costs, so factor these into your decision-making process. Always keep resale considerations in mind, as the type of insurance you choose can affect your vehicle's market value.

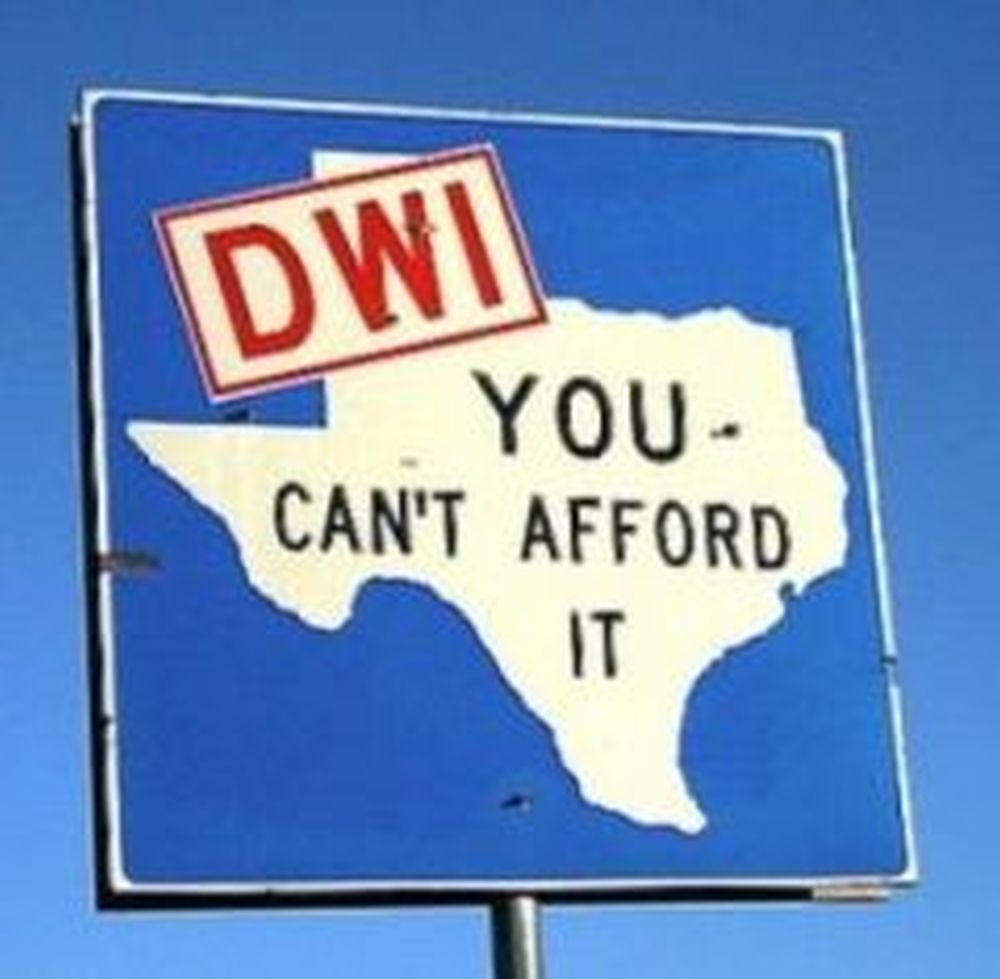

Understanding legal requirements is another important aspect. Most states mandate minimum liability coverage to protect others in the event of an accident. While personal injury protection is optional, it's often recommended for a more thorough safety net. Familiarize yourself with your local regulations, as penalties for noncompliance can include fines or license suspension.

Be aware that coverage limits vary by state, so verify that you meet or exceed these minimum requirements.

Evaluating your financial situation is equally important. Analyzing premium costs against your coverage needs will help you find a balance that works for your budget. Higher deductibles can lower your premiums but might increase your out-of-pocket expenses if you need to file a claim.

Consider your financial capacity to pay for both coverage and potential claims. Allocating your budget effectively among insurance and other expenses will guarantee you maintain adequate protection without overextending your finances. Don't forget to look for discounts, as these can greatly reduce your overall costs.

When comparing insurance providers, focus on their reputation and customer satisfaction ratings. You want a provider that offers policy customization to suit your unique requirements, along with responsive customer service for claims and inquiries.

Evaluate their financial health to confirm they can fulfill claims and manage risks effectively. Finally, consider local risks, including weather conditions, crime rates, and environmental factors, as these can necessitate specific additional coverage.

Regularly reviewing and adjusting your coverage is crucial as your circumstances change. Life events, such as changes in marital status or relocation, may require you to revisit your insurance needs.

Conclusion

In the grand tapestry of driving, selecting the right auto insurance coverage weaves a protective thread that shields your financial future. It's not just about meeting legal requirements; it's about crafting a safety net that fits your unique lifestyle. By balancing thorough protection with manageable premiums, you're not only investing in peace of mind but also in your driving experience. So, take the time to evaluate your options—you'll be steering through life with confidence and security at your side.